While multiple industry sources have told us Dell could be looking to offload its storage business and invest the capital more profitably somewhere else, the company has forcefully denied this, telling me: “We don’t normally comment on rumor or speculation, but given what you’re hearing, we wanted to make it 100 percent clear on the record: the rumor is false. We continue to invest heavily in our industry-leading storage portfolio and remain dedicated to delivering value for our customers.”

Dell has carried out some amazing corporate transformations. After going public in 1988 it went private in 2013 in a $25 billion deal. It bought EMC and subsidiary VMware for $67 billion in 2015. It went public again in 2018 in a complicated deal that avoided an IPO by buying VMware tracking stock for around $24 billion. And it sold VMware to Broadcom in a $69 billion deal.

Now it’s facing down – and denying – rumors going back several months that it may get out of the EMC-based storage business through a leveraged buyout or by finding a buyer.

Why are the rumors persisting, as they have over several weeks? Dell’s storage business revenue has been declining over recent quarters whereas its server business has shot up and its PC business is set for a revenue increase through an AI PC refresh cycle.

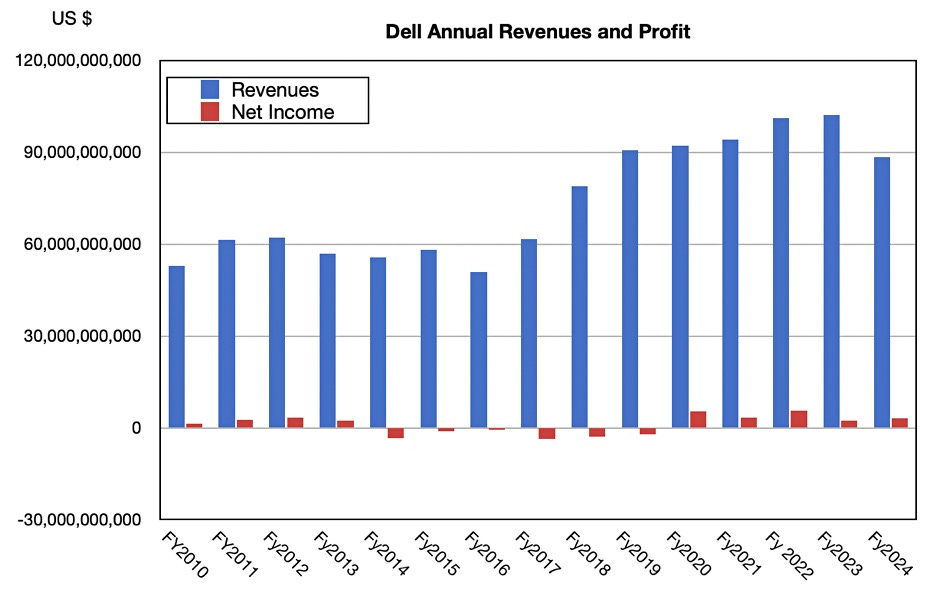

Dell’s overall business revenues have declined from a peak in fy2022

:

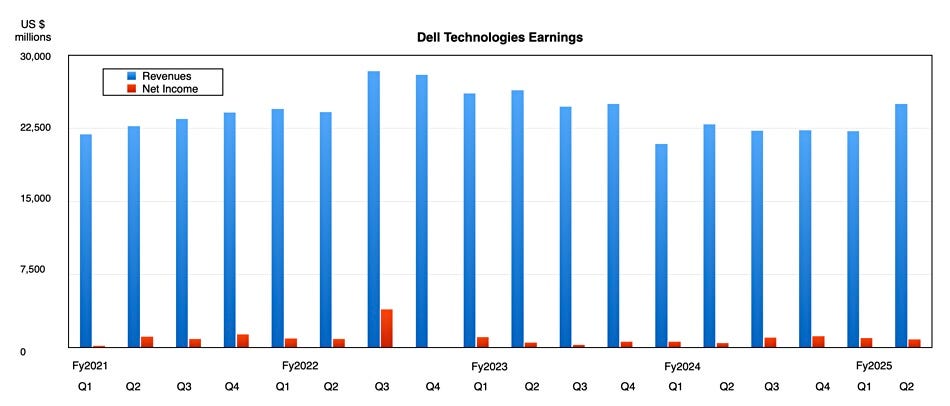

Quarterly revenues peaked in the third fy 2022 quarter and have trended down since then. But with a recent uplift in its latest Q2 fy2025 period

:

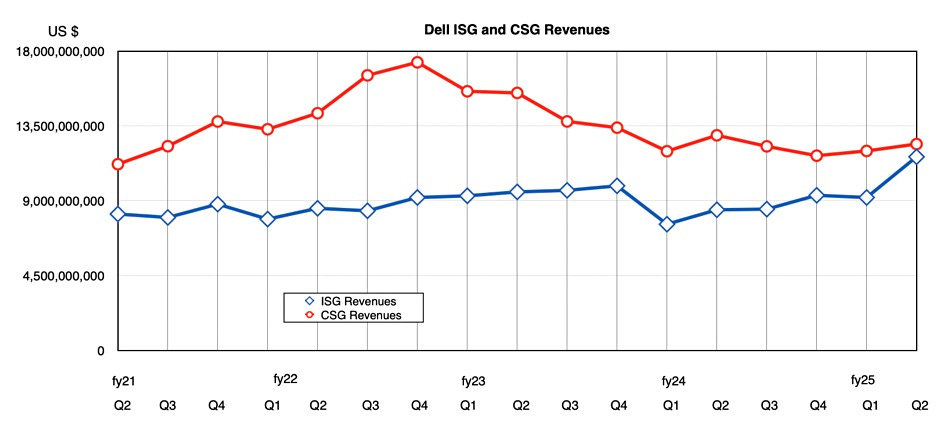

The company reports its revenues in two business units – CSG (Client Solutions Group) and ISG (Infrastructure Systems Group). CSG provides laptops, PCs and workstations while ISG is divided into a servers and networking segment and a storage one. CSG historically brings in more money than ISG but has fallen off in the last couple of years and is approaching parity:

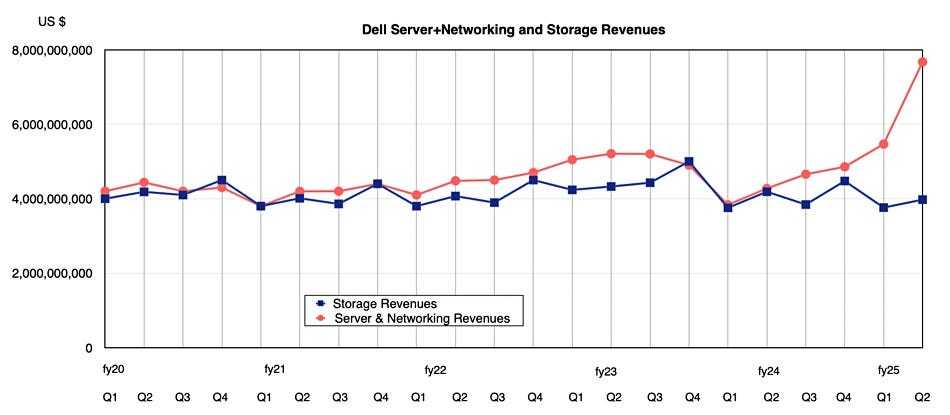

We can see that ISG revenues have been trending up since Q1 fy2024. Why is that? A look at the two ISG reporting units tells us:

Storage has been generally steady between $4 billion and $4.5 billion, peaking at $5 billion in Q4 fy 2023 ad then trending downwards. Combined servers and networking have provided the recent growth engine for the five quarters since Q1 fy2024 with a huge spurt in the latest quarter, Q2 fy2025. The rumors say storage is holding Dell back. CSG revenues have turned to growth in the most recent two quarters. Servers and networking has been rising for five quarters and storage is looking pedestrian.

It’s got all these different operating systems to maintain and develop, for PowerMax, PowerStore, PowerProtect, PowerFlex, Power whatever; costly and a far cry from having a contractor packaging PC components with Windows.

Jeff Boudreau

Long-term EMC-joined-Dell exec Jeff Boudreau looked after the storage business for several years and was then promoted to Chief AI Officer. He resigned in August with Global CTO John Roese taking on the Chief AI Officer role alongside the CTO duties. That leaves just one long-serving EMCer in Dell’s exec ranks, Bill Scannell, President Global Sales & Customer Operations. It’s nothing specifically to do with storage.

The EMC execs have largely gone, the storage business is flat and, so the rumors start that Dell will pull off another financial coup, and perhaps do a storage leveraged buyout or sell the business unit to an organization that specializes in getting profits out of substantial long tail businesses. Step forward Hock Tan, CEO of Broadcom, or so say the whisperers.

This is such a neat pitch that it makes you suspicious; it’s just too neat. And, anyway, storage may be flattish now but, as AI tech ramps, rightly or wrongly, it will need petabytes of unstructured data stored to feed the AI agents that will be running on its PCs and servers. Step forward PowerScale and the mass data storage products.

As less-than captivated customers exit price-raising Broadcom-owned VMware, step forward Dell - Nutanix alternatives with Dell storage, as well as Dell’s own HCI systems.

Additionally, the storage business could be - and surely is - a cash flow money-making machine for Dell, and it would be counter-productive to let it go to someone else. So, to reiterate: “We don’t normally comment on rumor or speculation, but given what you’re hearing, we wanted to make it 100 percent clear on the record: the rumor is false. We continue to invest heavily in our industry-leading storage portfolio and remain dedicated to delivering value for our customers.”