Nutanix has never made a profit. It has time, customers, and cost challenges to overcome but says it is making strong and fast progress towards profitability. Wall Street analysts agree.

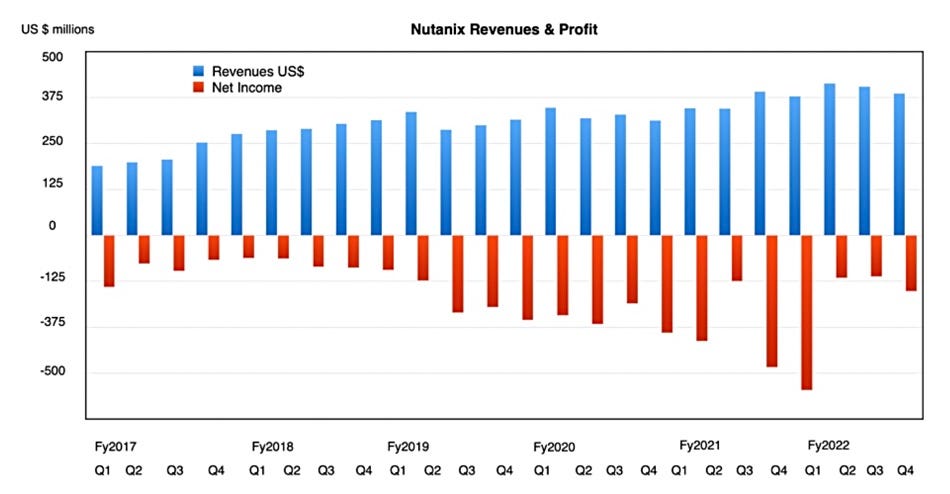

In its latest quarter (Q4 fy 2022), revenues were $385.5 million with a loss of $151 million. The company has never made a profit and seems perennially loss-making. Here’s a chart showing Nutanix (GAAP) proft and loss history;

Nutanix is gaining around 600 new customers each quarter and recorded 22,600 customers in the quarter. Therefore, we can say that the average customer generated $17,058. On this basis Nutanix would have needed another 8,852 customers to break even in its latest quarter, meaning 31,452 total customers.

As a comparison point, competitor VMware says it has more than 30,000 vSAN customers.

There have been much reduced losses in the last three quarters since CEO Rajiv Ramaswami came on board in December 2020. It has taken him four quarters before he could cut the losses down to the sub-$151 million/quarter level, and he has further to go.

At the start of 2021, Nutanix had 6,080 employees. It is a software company – people are its main cost.

During its latest quarter, Nutanix announced it was cutting 270 jobs, mostly non-quota-bearing sales and marketing staff, and would save between $55 million and $60 million annually. That comes out as $14.4 million a quarter. On that basis, were Nutanix to cut headcount to eliminate is latest quarterly loss, $151 million, it would need to lay off 2,831 employees, not 270.

The simplistic conclusion from these three data points – losses, customer count, and employee savings – is that Nutanix needs more customers and fewer employees.

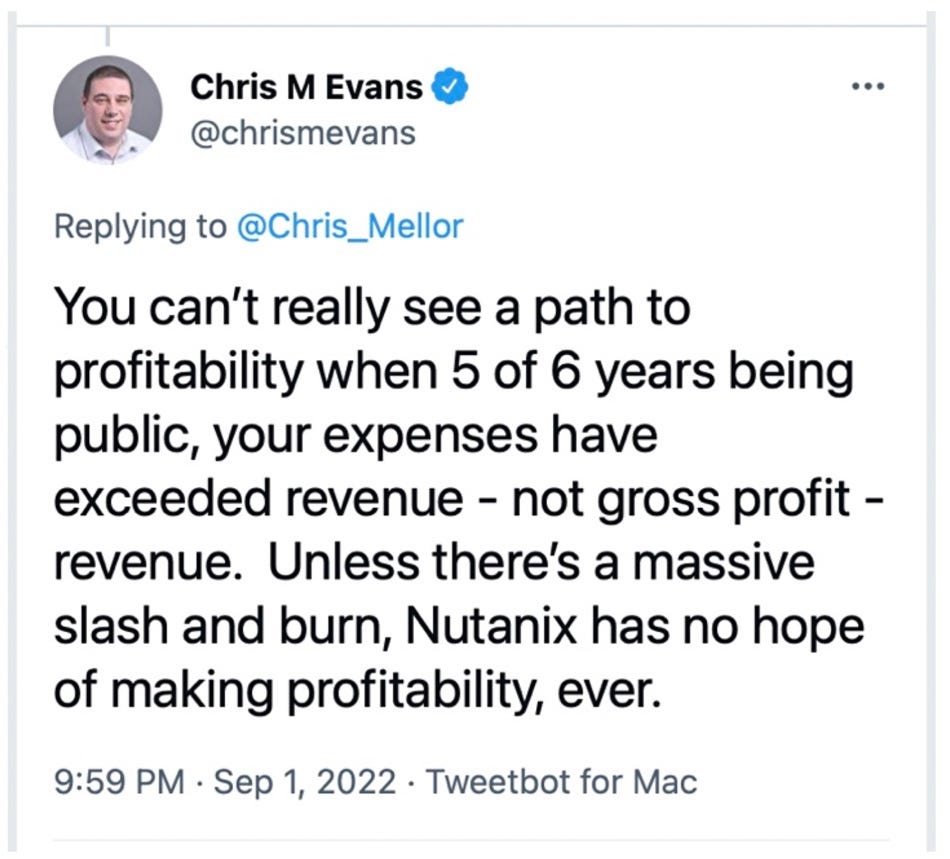

Consultant Chris Evans is in the fewer employees camp and has said: “Unless there’s a massive slash and burn, Nutanix has no hope of making profitability, ever.”

That’s the extreme view. It is not shared by Nutanix at all, or by most investment analysts. Understanding why has to do with the way profitability is calculated.

GAAP and non-GAAP

William Blair analyst Jason Ader explained there was a difference between GAAP (Generally Agreed Accounting Principles – which enable comparisons between businesses) and non-GAAP profitability which is generall specific to each business. For investment analysts non-GAAP is a commonly accepted way to evaluate software companies like Nutanix. Non-GAAP excludes non-cash expenses, most notably stock-based compensation and amortization of intangibles associated with acquisitions.

Ader said: “The main distinction here is accounting – i.e. GAAP vs. non-GAAP results. Nutanix expects to be profitable this FY on a non-GAAP basis, which excludes a number of expenses, the main one being stock-based compensation (SBC). This is a controversial and heavily debated topic in investment circles, but those that choose to exclude SBC values argue that the highly technical and probabilistic models involved in calculating SBC expense obscure measures of core performance and profitability.”

From Nutanix’s point of view, Ader is correct and the way to think about this is from a non-GAAP perspective. In GAAP terms, Nutanix made a net loss of $151 million in its latest quarter. Its financial statement includes a Reconciliation of GAAP to Non-GAAP Profit Measures section and there the non-GAAP net loss is closer to $38 million.

Calculating an average revenue per customer is too simple. It’s less about the absolute number of customers than about how much each customer deal is. Nutanix began its transition to subscription several years ago and is now largely a subscription business. Subscription renewals are starting to come in and contribute to revenue.

Free cash flow and operating margin

Wall Street financial analysts, like Ader, evaluate Nutanix on free cash flow and non-GAAP measures because these provide a lens through which to view the underlying characteristics of its business. GAAP measures, which include a lot of non-cash expenses, do not do that. Using non-GAAP numbers is Wall Street’s generally accepted way of analyzing software and technology companies.

Nutanix was free cash flow positive in fiscal 2022 and forecast an increased free cash flow, in the $75 million to $100 million range, for its fiscal 2023.

Nutanix guided for a non-GAAP operating margin of 2 percent for its fiscal 2023 in its latest earnings report. Therefore, on this non-GAAP basis, it is saying it will be profitable this fiscal year, and arguably means Nutanix will then be self-funding.

The GAAP profit numbers paint a much darker picture of Nutanx’s financial health which the non-GAAP measures correct. They show that it is making much faster progress to profitability than peering through the GAAP lens alone would indicate.