NetApp has filed an 8K SEC document saying it will lay off eight percent of its workforce because customers are spending less money than expected and the economy is in a downturn.

The layoffs will cost it $85 to $95 million, primarily in employee severance and benefit costs, and that should mostly be paid in its third fiscal 2023 quarter, which finished on January 28. The layoffs themselves should complete in the fourth fiscal 2023 quarter; by the end of April. The formal third FY2023 quarter results are expected towards the end of this month and are likely to be dire if NetApp has had to make these job cuts.

A letter to staff from CEO George Kurian read: “Today is undoubtedly a difficult day. The necessary steps we are taking to strengthen our competitive posture and enable us to emerge from this season better than we were before do not overshadow the impact that an action such as this has on our team.”

He explains: “Even as we work through this difficult time, it is imperative we continue to deliver on our commitments to our customers, shareholders and our employees.” Laid-off employees may well feel that NetApp has not delivered on its commitment to them.

This can be seen against a backdrop of recent and substantial tech industry layoffs: Amazon (18,000), IBM (3,900), Intel (504), Alphabet/Google (12,000), Microsoft (10,000), SAP (3,000), Salesforce (8,000), and Spotify (600). NetApp is now adding another thousand.

NetApp announced a six percent revenue rise to $1.66 billion in its second fiscal 2023 quarter, ended October 28, with $750 million in profits. But it experienced lower than expected cloud services revenue growth and detected signs of customers reducing their spending.

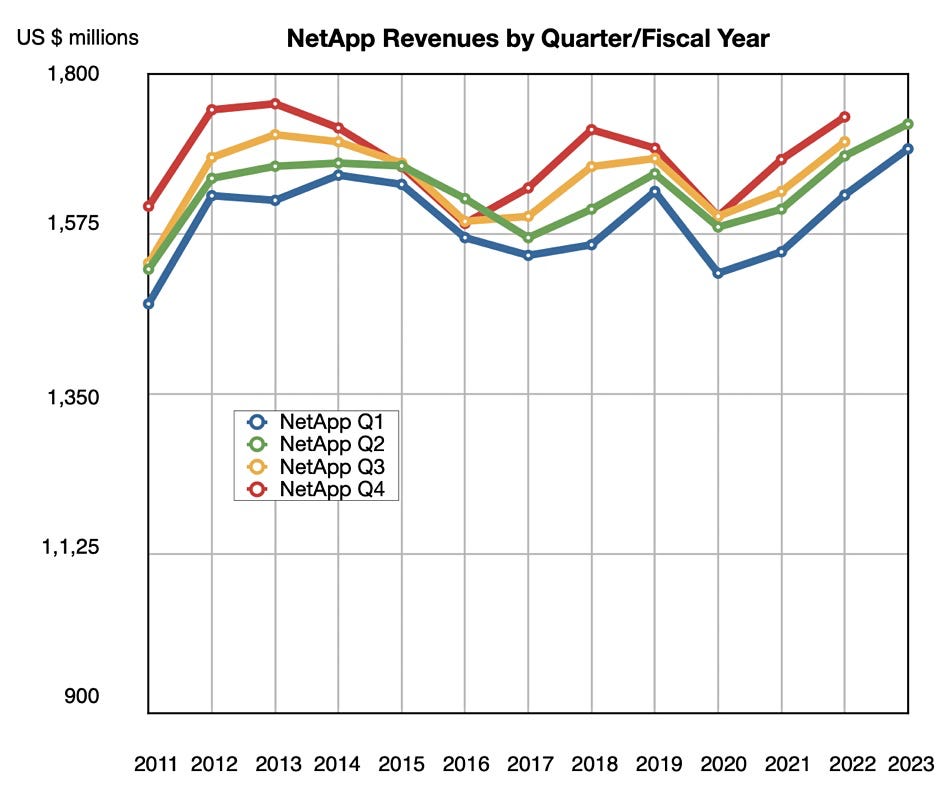

NetApp revenues by quarter by fiscal year up to its latest reported quarter, Q2 FY 2023. Its last downturn was in fiscal 2020.

On that account it put a hiring freeze in place, lowered operating expenses, reduced discretionary spending, optimized its real estate footprint, and moved resources away from lower yield activities to higher yield ones.

Now, just over one month later, it’s cutting around 960 jobs. Since it increased its headcount by 9.9 percent from 2021 to 2022 it is, in effect, getting rid of most of those positions – laying itself open to criticism of having over-hired in the year.

Just how bad do Q3 FY23 revenues have to be to justify such a swift and savage cull of its staff?

In FY20 its Q3 revenues dropped to $1.4 billion from the previous year’s $1.56 billion – a 10.5 percent drop. This was attributed to large enterprise customers slowing on-premises purchases, poor public cloud revenue growth and too many new sales reps not up to speed. NetApp then hired more sales people. This time around the downturn block, it’s not hiring, it’s firing; suggesting the quarter’s results could be even worse than Q3 FY20.

A final thought: unless NetApp is an outlier, other enterprise storage array providers are going to be experiencing the same market conditions, reporting revenue downturns and deciding how to cut costs. It could be bloody.