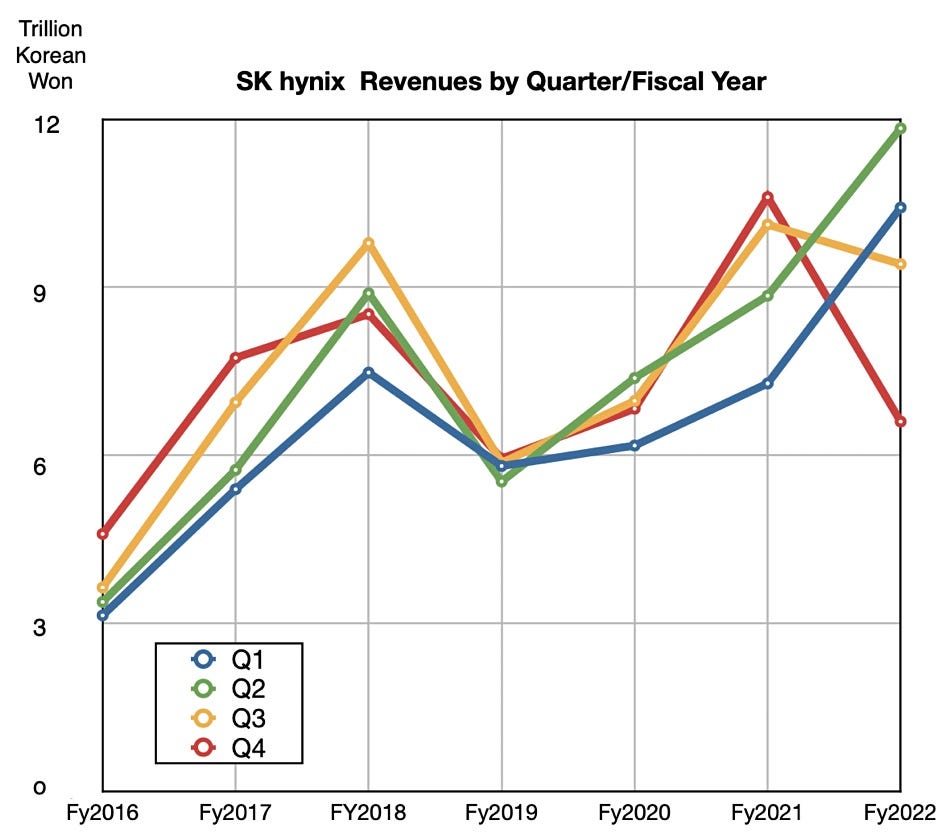

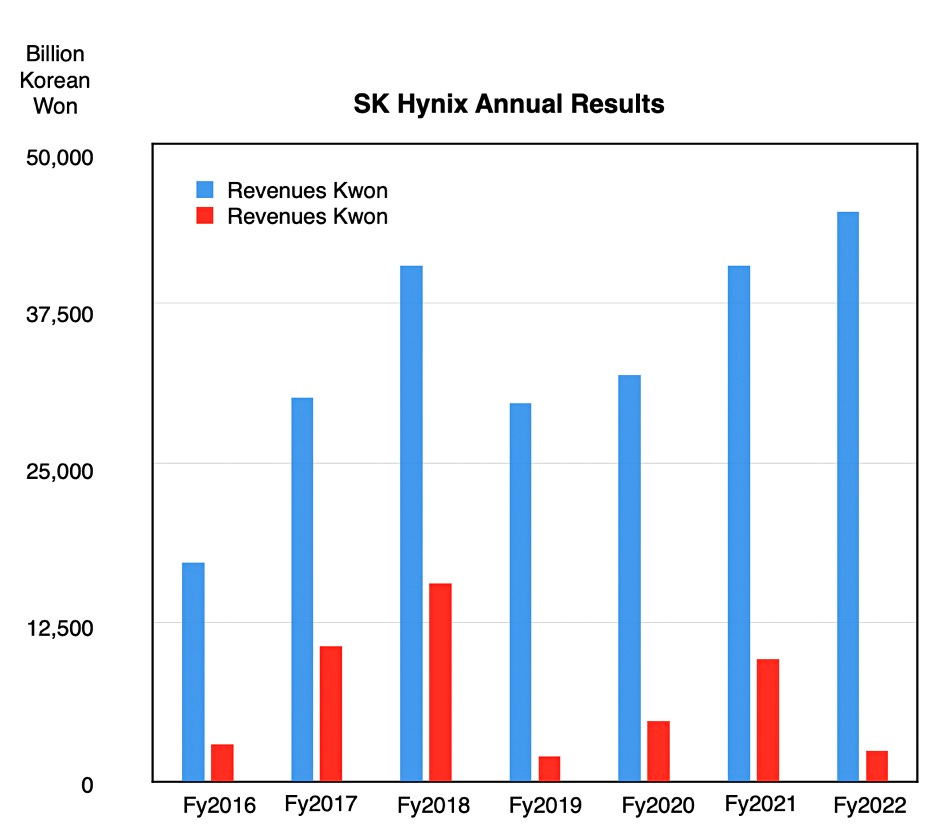

Korean DRAM and NAND fabber SK hynix got hit by the memory/NAND downturn with fourth 2022 quarter revenues down 38 percent and its first loss since the third 2012 quarter due to weak demand and a sharp fall in memory-chip prices.

Revenues were ₩7.7 trillion ($6.5 billion) and a massive ₩3.5 trillion ($2.9 billion) loss. Full year revenues were up 4 percent to ₩44.65 trillion ($37.7 billion) with a profit of ₩2.44 trillion ($2.1 billion) compared to ₩$40.45 trillion ($34.12 billion) revenues and a profit of ₩9.62 trillion ($8.12 billion) a year ago. The foul fourth quarter depressed the full year numbers. Samsung us also experiencing a downturn

CFO Woohyun Kim said. “With the world’s best technologies for DDR5 for data centers and 176-layer NAND flash-based enterprise SSD, we expect to see a quick turnaround when the market bottoms out. … A successful overcome of the current downturn will help us strengthen fundamental business competitiveness before eventually leaping forward as a leading technology company.”

Sk hynix, the global number 2 in memory chip production, said "Industry experts do not expect an increase in supply of memory chips as market players are planning to reduce investments and production, which will lead the inventories to peak within the first half.”

It forecasts market conditions to gradually improve into the latter part of the year, with a slow recovery in demand as global tech companies start to buy more memory chips with prices low. Woohyun Kim said: “Intel’s launch of new server CPUs adopting DDR5, and apparent positive signs of demand for new AI-based server memory chips, bode well for a quick business turnaround.”

Analyst Aaron Rakers from Wells Fargo came up with these product segment numbers;

DRAM revenues : ₩4.62 trillion ($3.4 billion) down 54 percent Y/Y and 34 percent Q/Q. The blended DRAM ASP ($/GB) is thought to have slumped 35 percent Q/Q. Rakers said SK hynix The company expects its wafer production growth to be negative in 2023 given production actions and technology migrations.

Reuters reports Woohyun Kim saying: “The recent drop in memory prices is the largest since the fourth quarter of 2008 ... industry-wide inventory is probably at an all-time high.”

NAND revenues: ₩2.4 trillion ($1.76 billion) down 25 percent Y/Y and 30 percent Q/Q, reflecting the acquisition of Intel’s NAND business, now called Solidigm. Blended NAND ASP declined in the mid 30 percent area, worse than Western Digital’s 20 percent decline in its blended NAND ASP in its equivalent quarter.

There is no data about the NAND revenue split between Solidigm and the rest of SK hynix’ NAND business.

In consequence SK hynix will decrease its DRAM shipment volume by a double-digit percent and there will be a single digit percent reduction for NAND shipments, both in this quarter and compared to 2022 numbers.

SK hynix thinks next quarter could be worse still in revenue downturn terms, with inventory levels reaching a peak, after which demand is expected to pick up. This will be helped by DDR5 DRAM and High-Bandwidth Memory (HBM3) demand from AI, big data analytics and cloud computing applications.